Hariom has years of experience bridging AI, machine learning and quantitative techniques with Finance. He is an O'Reilly author and published researcher. He has several research in AI and Machine Learning and is performing research in neuroscience-inspired mechanistic interpretability to understand the inner workings of LLMs. He advises startups and has been a featured speaker at several conferences and industry forums. He received the Indian Achiever Award in Machine Learning. He has a deep interest in physics, philosophy and simulation hypothesis.

No. 1 new release on Amazon.com in the AI category

Features of this book:

- 20+ real-world case studies of AI/ML in Finance

- Supervised learning for trading, pricing, and portfolio management

- Classification models for risk prediction and fraud detection

- Dimensionality reduction for portfolio optimization

- Clustering algorithms for pattern recognition

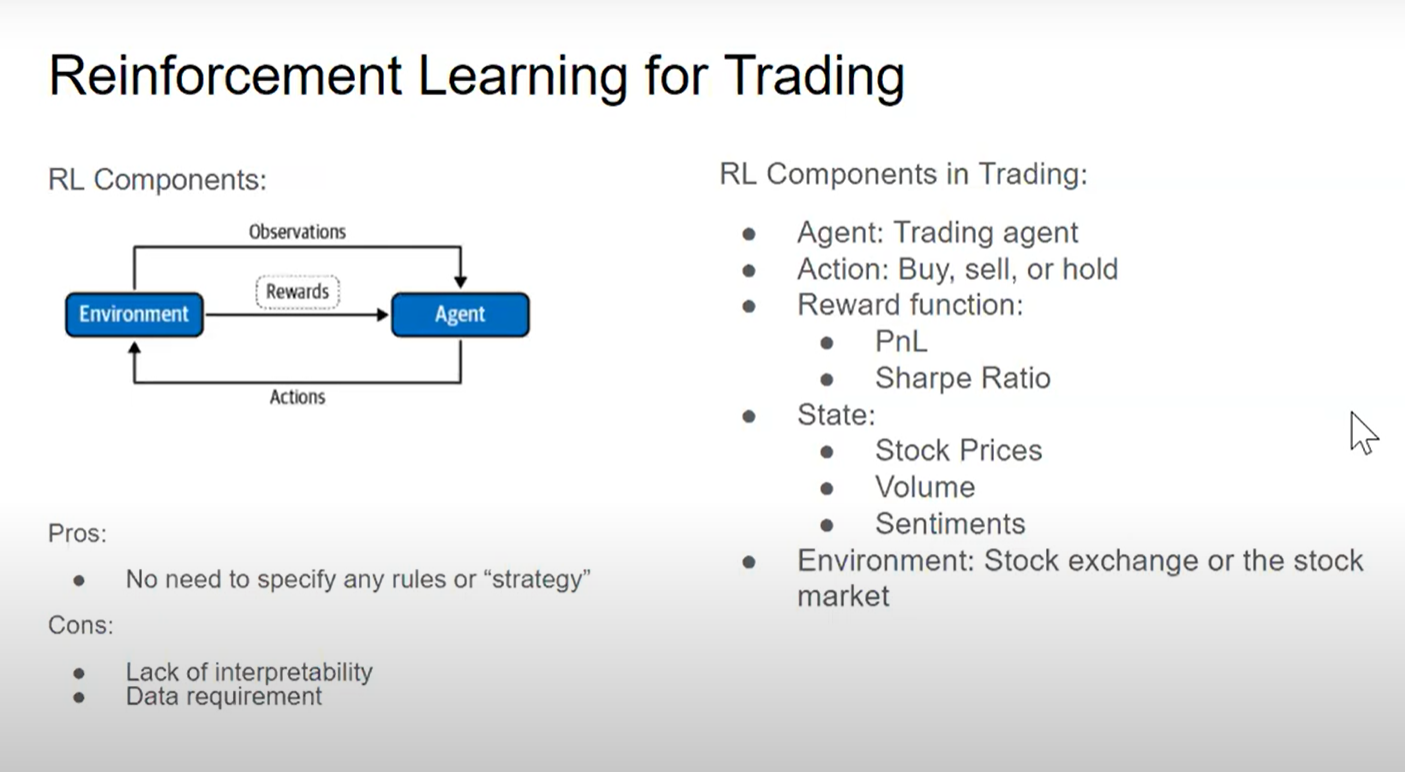

- Reinforcement learning for trading and hedging

- NLP techniques for sentiment analysis

- Code examples included for practice

Published: December 2020 by O'Reilly Media | Authors: Hariom Tatsat, Sahil Puri & Brad Lookabaugh

Contact

For inquiries, speaking engagements, or collaborations, please reach out: